Controversial announcement

Online gambling operators in New Jersey are up in arms over Governor Phil Murphy’s proposal to increase tax rates from 13-15% to 25% as part of his annual budget plan. He revealed this proposal on Tuesday to much outcry, with the budget not officially being confirmed until June 30.

lawmakers believe the tax increase would generate an additional $402.4m by 2026

Online gambling taxes in the Garden State totaled $497m last year, and lawmakers believe the increase would generate an additional $402.4m by 2026.

The current rate for sportsbooks is 13% and iGaming operators pay 15%. The hike to 25% for both would still be lower than operators pay in nearby Pennsylvania and New York, with the rates being 36% and 51%, respectively.

Calling on people to fight back

Gambling operators believe the plan is unjust and will make an already competitive market even tougher. The knock-on impact for users could be less competitive odds, smaller casino game selections, and fewer lucrative promotions, all of which could drive consumers to black market products.

issued a message to customers asking them to oppose Governor Murphy’s plan

FanDuel is the dominant player in the state and quickly emailed customers asking them to oppose Governor Murphy’s plan by sending personal messages to lawmakers:

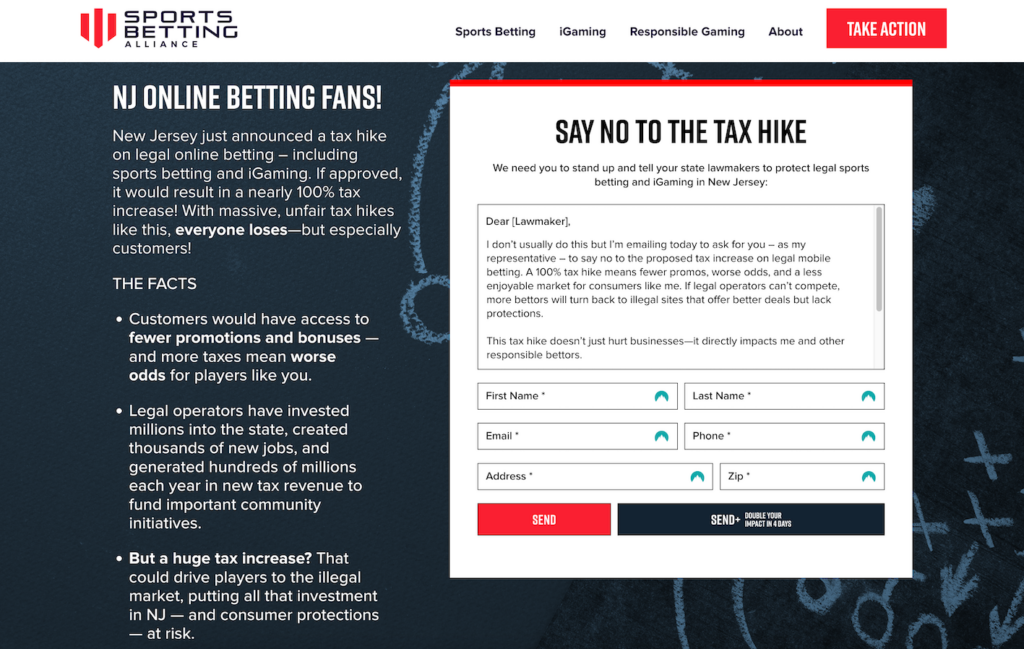

The Sports Betting Alliance, which includes BetMGM, FanDuel, and DraftKings, has a template on its website that people can copy and paste to send messages to their representatives in New Jersey:

Won’t have the desired impact

The influential Casino Association of New Jersey (CANJ) also opposes the tax increase, saying that it could negatively impact Atlantic City’s tourism and gaming industry.

The organization’s president, Mark Giannantonio, acknowledged it would bring in more money for the state, but the knock-on impact would be threatening the financial well-being of the casino’s sector and its employees, as it would lower consumer spending at properties.

Giannantonio also pointed out how similar tax increases in other states haven’t succeeded, saying the move would “not have the desired yield as it will result in diminishing returns through a consumer shift away from the licensed and regulated providers.”

Most notably, Illinois increased its online sportsbook rate last year from 15% to as much as 40%. Lawmakers in Maryland, Indiana, Ohio, and Massachusetts are considering bills to make similar changes.